Garage Door Opener Depreciation

Most homeowner policies cover contents for their full replacement cost, however if you elect not to replace an item, it will be settled for its Actual Cash Value (ACV). ACV means replacement cost less depreciation. Would you like to know how much an item will be depreciated if you elect cash instead of replacement? The items below were listed in The Columbus Dispatch regarding life expectancy of household items. The list might help you estimate what the depreciation might be. For example, if you have a 5 year old dishwasher with a life expectancy of 10 years and it is destroyed by fire, the insurance company will pay to replace the dishwasher at current replacement cost. However, if you elect not to replace the dishwasher and want cash instead, the company will pay its Actual Cash Value (ACV). Let’s say it would cost $500 to replace the dishwasher. In this example, the $500 cost to replace the dishwasher would be depreciated by 50%. (It is 5 years old and therefore has used half of its expected 10 year life.)

The company would offer $250 as a cash settlement. Whole House 10-15 years Coatings on wood floors Coatings on Interior Doors and Trim Carbon Monoxide Detector 5-10 years Chimney flue life of house Concrete steps 30+ years Adding gravel every 5 yrs Aluminum siding 20-30 years Asbestos shingles 15-30 years Asphalt siding 20-40 years Cedar siding 40-75 years Hardboard siding 10-25 years Redwood siding 40-100 years

T Shirt Hammond Vinyl siding 30 years

Bedroom Furniture Romania Fences Plastic 50 years

Running Man T Shirt Philippines Wrought iron 50-100 years Fire extinguisher 12 years Ceramic tile 50-100 years 10-15 years if sealed Galvanized steel 60-70 years

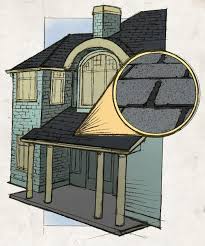

In-ceiling fixtures 7-25 years Motion lights 1 year High Quality 15-20 years Med Quality 7-10 years Galvanized steel 15 years (Water) Cast iron Life of house Asphalt shingles 15-20 years Asphalt rolls 10 years Clay tiles 20 years Cement tiles 20 years Metal roofing 15-40 years Slate shingles 30-100 years Wood shingles 10-40 years Cast iron 70-90 years Cast iron 50 years Galvanized steel 25-40 years Electric service box 20-30 years The estimated longevity of items in this list is based on the assumption of proper maintenance. Figures were gathered from a variety of associations, retailers, manufactures and repair services. List reprinted from The Columbus Dispatch article Life Expectancy on 4/30/2000. W.E. Davis Insurance is here for you when you need us. We have incurred costs for substantial work on our residential rental property. We replaced the roof with all new materials, replaced all the gutters, replaced all the windows and doors, replaced the furnace, and painted the property’s exteriors.

What are the IRS rules concerning depreciation? Replacements of the entire roof and all the gutters, and all windows and doors of your residential rental property: Are generally restorations to your building property because they are replacements of major components or substantial structural parts of the building structure. As a result, these replacements are capital improvements to the residential rental property. Are in the same class of property as the residential rental property to which they are attached. Are generally depreciated over a recovery period of 27.5 years using the straight line method of depreciation and a mid-month convention as residential rental property. Repainting the exterior of your residential rental property: By itself, the cost of painting the exterior of a building is generally a currently deductible repair expense because merely painting is not an improvement under the capitalization rules. However, if the painting directly benefits or is incurred as part of a larger project that is a capital improvement to the building structure, then the cost of the painting is considered part of the capital improvement and is subject to capitalization.

In this case, the painting is incurred as part of the overall restoration of the building structure. Therefore, the repainting costs are part of the capital improvements and should be capitalized and depreciated as the same class of property that was restored, as discussed above. Replacement of the furnace in your residential rental property: Is generally a restoration to your building property because it is for the replacement of a major component or substantial structural part of the building’s HVAC system. Therefore, the furnace replacement is a capital improvement to your residential rental property. As with the restoration costs discussed above, these costs are in the same class of property as the residential rental property to which the furnace is attached. Is generally depreciated over a recovery period of 27.5 years using the straight line method of depreciation and a mid-month convention as residential rental property. Note: A taxpayer whose average annual gross receipts is less than or equal to $10,000,000 may elect to not capitalize amounts paid for repairs, maintenance, or improvements of certain eligible building property if the total amounts paid during the taxable year for such activities do not exceed certain dollar limitations.

For more information, see Safe Harbor Election for Small Taxpayers in Tangible Property Regulations - Frequently Asked Questions. Publication 527, Residential Rental Property (Including Rental of Vacation Homes) Publication 946, How to Depreciate Property Sale or Trade of Business, Depreciation, Rentals Please provide your feedback. 1. Was it easy to find your information within the above Frequently Asked Question? 2. How satisfied are you with the information provided within the above Frequently Asked Question? 3. If you still need help from the IRS, what would your next step be? No additional help is needed Continue to search IRS gov web site The OMB number for this study is 1545-1432. If you have any comments regarding this study, please write to: Back to Frequently Asked QuestionsThe following chart details the predicted life expectancy of appliances, products, materials, systems and components. (For homes located in Florida and the surrounding coastal region, please refer to InterNACHI's Florida Estimated Life Expectancy Chart for Homes.)

Consumers and inspectors and other professionals advising their clients should note that these life expectancies have been determined through research and testing based on regular recommended maintenance and conditions of normal wear and tear, and not extreme weather (or other) conditions, neglect, over-use or abuse. Therefore, they should be used as guidelines only, and not relied upon as guarantees or warranties. ADHESIVES, CAULK & PAINTS FASTENERS, CONNECTORS & STEEL INSULATION & INFILTRATION BARRIERS MOLDING, MILLWORK & TRIM PLUMBING, FIXTURES & FAUCETS Toilets, Bidets and Urinals Radon systems have but one moving part: the radon fan. SIDINGS, FLASHING & ACCESSORIES Note: Life expectancy varies with usage, weather, installation, maintenance and quality of materials. This list should be used only as a general guideline and not as a guarantee or warranty regarding the performance or life expectancy of any appliance, product, system or component.